The bill backed by Senate Republican leadership would divert lodging tax dollars that currently fund tourism promotion and small-town economic development to lower homeowner tax bills.

By Eric Dietrich MONTANA FREE PRESS

Lawmakers who want to offer Montana residents substantial immediate property tax relief face an inescapable mathematical reality: Unless they want to force local governments to lay off cops and teachers, the money to lower residential property tax bills has to come from somewhere.

That somewhere, for one of the first major tax relief proposals to get a hearing before a legislative committee this year, is the state’s current pair of bed taxes: a 4% lodging facility use tax and a 4% lodging sales tax.

Together, those taxes collect about $120 million a year, a figure that’s about twice what it was before the COVID-19 pandemic. According to a fiscal analysis prepared by the governor’s budget office, about $40 million of that currently goes to tourism promotion and about $50 million to the state’s General Fund.

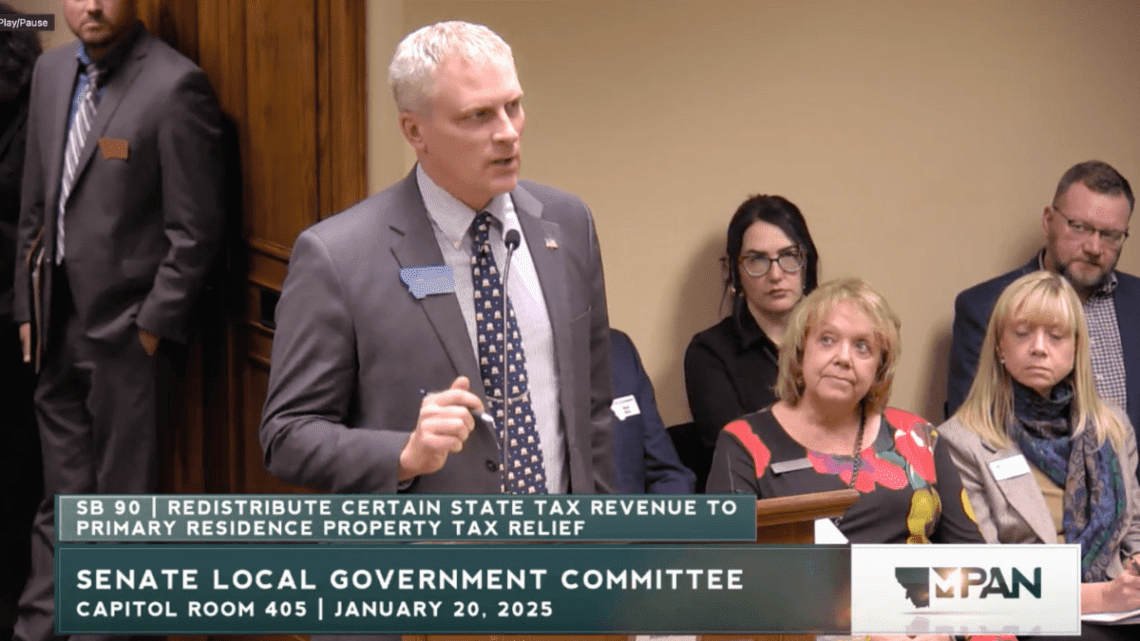

Sen. Carl Glimm’s Senate Bill 90 would take that $90 million and revenue from another tax on rental vehicles to put roughly $100 million a year toward reducing homeowner property tax bills. The fiscal analysis estimates that redirection could reduce taxes on primary residences by about $450 a year.

“I think we have all heard loud and clear from our constituents that property taxes are a problem, and so this is an attempt to get them a credit back,” Glimm, a Republican from Kila, told the Senate Local Government Committee Monday afternoon.

Glimm’s measure has drawn an endorsement from the Senate’s Republican leadership, including Senate President Matt Regier, R-Kalispell.

“There’s a big sentiment in Montana of ‘Why are we spending millions of dollars to attract more people to move in and buy the house next door and raise your property taxes?’” Regier said during a Jan. 14 press briefing. “That money should be going back to Montanans to ease the burden of tourism.”

The bill was opposed at Monday’s hearing, however, by a long line of tourism industry and community boosters, each of whom stepped up to the podium to argue that the bed tax dollars, which currently fund tourism promotion, visitor research and economic development programs, are being put to vital use.

“Tourism is an economic driver, regardless of how any of us feel about visitors coming to Montana,” said Montana Department of Commerce Deputy Director Mandy Rambo.

Rambo told lawmakers other states that have tried cutting back on tourism promotion thinking it’s unnecessary spending, like Colorado, have seen declining visitor numbers and hefty economic consequences. If Montana dials back its promotional efforts, she said, fewer visitors could mean lower bed tax collections, ultimately limiting how much property tax relief the bill can provide.

Among the programs that would be defunded if the bed tax diversion bill is passed, Rambo said, are domestic and international tourism marketing efforts, the state’s Made in Montana program, the Main Street Montana downtown revitalization program and international trade offices in Japan and Taiwan. The University of Montana’s Institute for Tourism and Recreation Research is also on the chopping block.

Research by the tourism institute estimates that nonresident visitors spent about $5.8 billion a year in Montana in 2022 and 2023, more than $1 billion of that in Kalispell’s Flathead County and nearly $1 billion in Bozeman’s Gallatin County.

The institute’s research has also tracked a long-term decline in the number of Montanans who tell researchers they believe more tourism would increase the state’s overall quality of life. About two-thirds of survey respondents agreed with that sentiment as recently as 2015. In 2023, the fraction was down to one-third.

Rambo said the state commerce department, which reports to Gov. Greg Gianforte, favors a different tax relief proposal, Rep. Llew Jones’ House Bill 231. That bill, which is set for its initial hearing Wednesday, would reduce taxes on primary residences and small businesses by raising them on second homes and Airbnb-style vacation rentals.

Other opponents of the bed tax bill at Monday’s hearing included representatives from the Montana Chamber of Commerce, the Montana Travel Association, the Montana Restaurant Association, the Montana Outfitters & Guides Association, the Montana Farmers Union, the Montana Heritage Commission, various local tourism promotion organizations and the owners and operators of several tourism-focused businesses.

“The lodging facility use tax has always been an investment in Montana’s prosperity, and must remain dedicated to its purpose,” said Racene Friede, the president of Western Montana’s Glacier Country, a tourism promotion organization.

“While we all appreciate the bill’s intent, we have serious concerns about the potential to impact Montana’s tourism economy,” Friede said.

Glimm dismissed those concerns, arguing that the Montana tourism industry is healthy enough that it doesn’t need to be promoted with bed tax dollars.

“Tourism is valuable. I get that. But tourism is also alive and well — try and visit Glacier Park. Try and go camping. Try and get a hotel almost anywhere. Tourism is alive and well in Montana,” Glimm said.

“I don’t know of another industry that state government does the vast majority of the advertising for,” he added, “and I’m not sure if that’s actually state government’s place.”